Nigeria delisted from EU AML backlist, NFIU boss credits Tinubu’s anti-crime drive for ‘major win’

The European Union has delisted the Nigeria from its high-risk jurisdictions for money laundering and terrorist financing, effective January 29, 2026.

This follows the European Commission Delegated Regulation (EU) C (2025) 8460, greenlit on December 4, 2025, mirroring the Financial Action Task Force (FATF)’s October 2025 Plenary decisions. Nigeria joins Burkina Faso, Mali, Mozambique, South Africa, and Tanzania, all cleared after plugging FATF grey-list gaps in June and October 2025.

The EU praised Nigeria for boosting its AML/CFT regime, closing technical gaps, and meeting FATF Action Plan commitments.

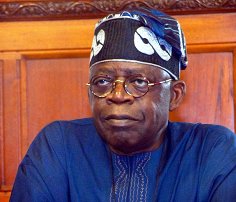

CEO of the Nigerian Financial Intelligence Unit (NFIU), Hafsat Bakari, credit President Bola Tinubu’s leadership, alongside collaboration from the National Assembly, law enforcement, regulators, judiciary, private sector, and development partners.

She hailed the move as “a significant affirmation of Nigeria’s collective reform efforts.” She added, “This decision represents an important external validation of Nigeria’s steady progress in strengthening its AML/CFT/CPF framework. It demonstrates that consistent reforms, effective coordination and strong national ownership can translate into tangible international outcomes.”

The delisting lifts enhanced due diligence burdens on Nigeria-EU financial transactions, paving the way for smoother cross-border flows, reduced compliance costs, and boosted appeal for trade and investment. In a competitive global market, it cements Nigeria’s status as a dependable partner, with Europe remaining a hub for Nigerian exports and inflows.

Bakari emphasised the wider ripple effects: “Beyond the immediate economic benefits, this outcome strengthens international confidence in Nigeria’s financial system and underscores our standing as a cooperative and responsible participant in the global financial architecture.”

She spotlighted the NFIU’s pivotal role in coordinating efforts, refining financial intelligence, and aiding investigations nationwide. “This achievement is the product of collective national effort. While we welcome this progress, it also places a clear responsibility on all stakeholders to sustain momentum, guard against complacency and continue strengthening our systems in response to evolving financial crime risks,” Bakari stressed.

Looking ahead, the NFIU vows deeper collaboration with FATF, GIABA, the EU, and local players to keep Nigeria ahead of financial threats. She added that as Nigeria’s core for dissecting laundering and terror finance intel—and an Egmont Group member—the NFIU safeguards the nation’s economic backbone.